This year’s deadline for filing IRS Tax Returns has come and gone. As millions of Americans are still reeling from Tax Day, it’s important to keep in mind how to protect yourself from future tax increases. Or, better yet, whom to protect yourself against.

In Washington State, that’s an easy call. Democrats have consistently pushed for tax increases, and if the liberals had their way, working families would have paid a state income tax on top of the federal income tax this year.

Time after time, Washington State voters have defeated state income tax initiatives. The last time, in 2010, voters rejected an income tax initiative by a 28% margin. Unfortunately, as Shift reported in the past, over 64% of Washingtonians voting against a state income tax is not enough to fend off Democrats and their obsession for a state income tax.

Just how committed are local Democrats with the state income tax? Well, they listed it as a key aspect of their party platform. In fact, the Washington State Democrat Party lists a state income tax as a “guiding principle.”

Additionally, Democrat lawmakers have introduced a state income tax proposal in every legislative session in recent memory. The 2016 legislative session was no exception.

Though Democrat lawmakers introduced various proposals, the bill that received the most attention was a graduated state income tax scheme that would be imposed by a constitutional amendment. Of course, the bill ignored key limitations – including that fact that it remains unlikely the proposal would make any progress with voters and that the state constitution requires taxation of property, including income, to be uniform and limited to 1%.

The only hope Democrats have is if the current – and very liberal – state Supreme Court decides to simply ignore years of established precedent. Unfortunately, that’s a real possibility.

The state Department of Revenue (DOR) hinted at the possibility earlier this year in an email to the Washington Policy Center. The agency wrote, “Revenue as an agency doesn’t take a position on whether the current court would follow the old precedents and hold a graduated or targeted income tax unconstitutional.”

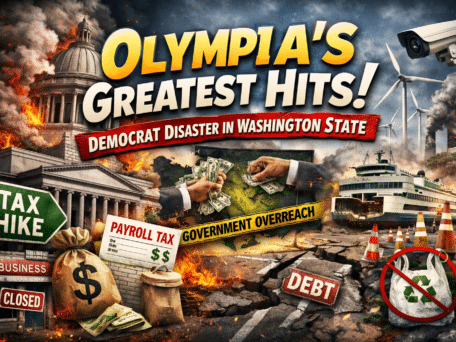

It’s not just Democrat legislators and the liberal state Supreme Court to watch out for – it’s also Jay Inslee. Our green governor promised that he would not propose new taxes during his 2012 gubernatorial campaign. Then, as could be expected, Inslee promptly broke his promises at the first opportunity.

Since the beginning of his term, Inslee has introduced various forms of tax increases including a state income tax – in fact, he has asked for tax increases every year, despite state revenue growing every year. Prior to the 2015 legislative session, Inslee pushed a state capital gains income tax.

And, just this week, our green governor took a significant step to ensure that he and his fellow Democrats will not miss out on the opportunity to call for tax increases next year (should Inslee be re-elected, to the detriment of our state). When Inslee yesterday signed the supplemental budget that was written to balance over the next four years, he decided to veto several provisions in the budget that now puts the state more than $200 million in the red.

As GOP Senate Majority Leader Mark Schoesler points out, Inslee’s action is a clear signal of his intent to leave the door open for new taxes.

“Governor Inslee has been pushing for tax increases since he took office. This veto of around 200 million dollars in savings is another example of how he’s trying to set the stage for new and higher taxes,” Schoesler said.

The actions of Democrats this year (and, indeed, every year) reaffirms what many voters already know, and are reminded every Tax Day – Democrats are obsessed with the idea of raising taxes on working families.

The question is, should Democrats continue to control Olympia, in what year will Washington State taxpayers find themselves paying both a state and federal income tax on Tax Day?