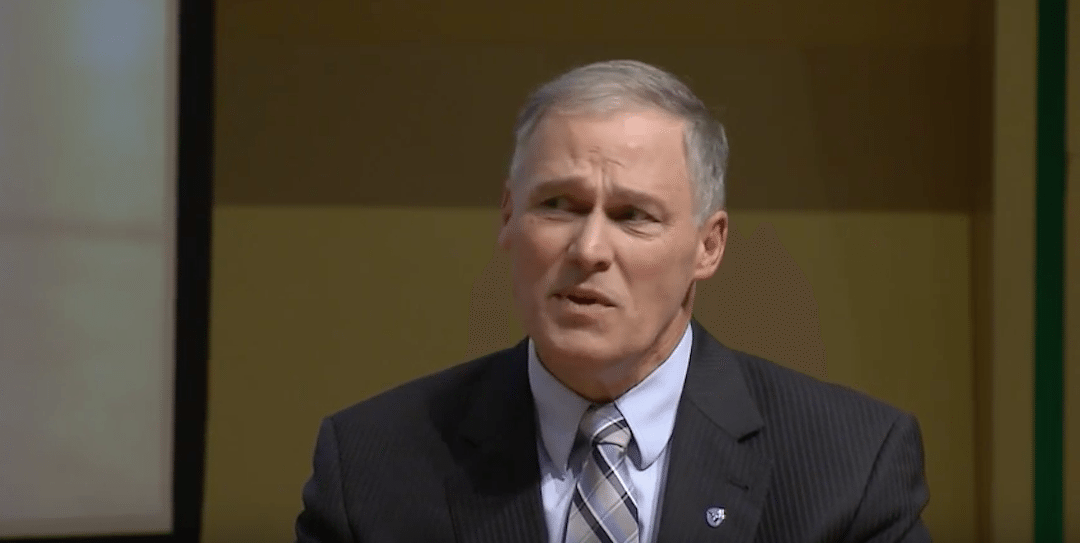

Gov. Jay Inslee is starting his fourth regular legislative session as governor, and it marks the fourth time that he’s tried to raise taxes during his term. That makes it four years in a row that he’s broken his promise from the 2012 campaign, when he assured voters, “I would veto anything that heads the wrong direction and the wrong direction is new taxes in the state of Washington.”

Inslee isn’t sitting back and waiting for tax hikes to land on his desk. He’s actively pushing for higher taxes with a proposal he outlined last month in his supplemental budget proposal.

The governor made that proposal official today when Rep. Christine Lytton (D-Anacortes) filed “request legislation” on behalf of the Office of Financial Management – Inslee’s in-house budget office. HB 2479 lays out the tax increases Inslee is pushing this year:

- Enacting a sales tax on bottled water. State government has done this before. Legislators passed a bottled water tax in 2010, but voters promptly repealed it through Initiative 1107 that fall. Inslee rejects their clearly-stated preference.

- Ending the automatic sales tax deduction for out-of-state residents. This would hurt businesses along the Oregon border because crossing into Washington to purchase products would be less attractive to Oregon residents, who don’t pay sales tax in their own state.

- Limit the Real Estate Excise Tax exemption for banks. This provision is related to foreclosed properties.

- Limiting the extracted fuel tax to biomass fuel from wood waste. This is Inslee’s attempt to tax the state’s oil refineries for fuel they use and burn off as part of the refining process. Like other fuel taxes, drivers will ultimately pay for this one at the pump. Rep. Drew Stokesbary (R-Auburn) tweeted last month, “Just so we’re clear, taxing extracted fuel is like taxing you for compost made from your food scraps & used in your garden.”