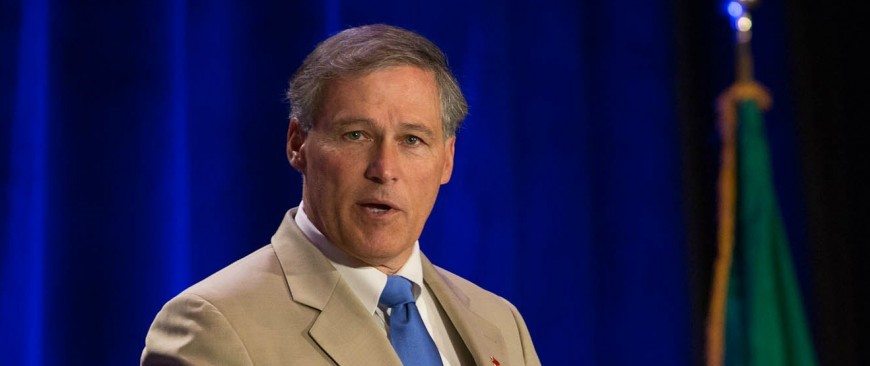

When Gov. Jay Inslee announced yesterday that he was breaking his campaign pledge against tax increases yet again, he singled out four tax increases he wants the Legislature to pass in 2016. If they sounded awfully familiar, there’s a reason: each idea is a retread from past sessions.

As described by TVW’s The Capitol Record, Inslee is seeking the following four tax hikes:

–Refund the state portion of sales tax to nonresidents: Shoppers from states with no sales tax, like Oregon, would have to apply for a state sales tax refund on purchases in Washington. No longer would the discount be applied instantly. Saved over three years = $79.3 million

-Repeal the sales tax break on bottled water: Saved over three years = $82.9 million

-Limit the real estate excise tax exemption (REET) for banks: Connected to foreclosed properties. Saved over three years = $106.7 million

-Repeal the use tax exemption for extracted fuel: Claimed by the state’s oil refineries. Saved over three years = $58.6 million

Note that “saved” above means “added to state government.” Not one of those proposals is new. Each was introduced by Inslee or House Democrats last year, yet none even made it out of committee. Inslee told reporters, “Having a classroom teacher to teach algebra right now is more important than some oil industry tax break that ended up getting done 20 or 30 years ago that doesn’t even apply anymore.”

State Sen. Andy Hill (R-Redmond), the Senate budget writer, fired back: “Unfortunately, as has become a yearly tradition, the governor continues to offer plenty of ways to spend taxpayer dollars, but fails to provide a sustainable way to pay for it.”

Same ideas, same problems

Businesses along the Oregon border are sure to protest again this year to ending the out-of-state sales tax exemption. They fear, rightly, that moving to a refund system will depress sales from Oregon residents traveling across the river.

The bottled water tax is unique in that the same tax was specifically repealed by voters before. After legislators imposed a temporary sales tax on bottled water, voters repealed it through Initiative 1107 in fall 2010.

That Inslee is aiming for the tax exemption on extracted fuel is no surprise. Democrats have been proposing that one for years, calling it a tax break for “Big Oil.” Logically though, it’s tough to object to the exemption. As it stands now, the exemption means the state does not tax refineries for fuel they recycle and use within the refining process itself.

State Rep. Drew Stokesbary (R-Auburn) tweeted, “Just so we’re clear, taxing extracted fuel is like taxing you for compost made from your food scraps & used in your garden.”