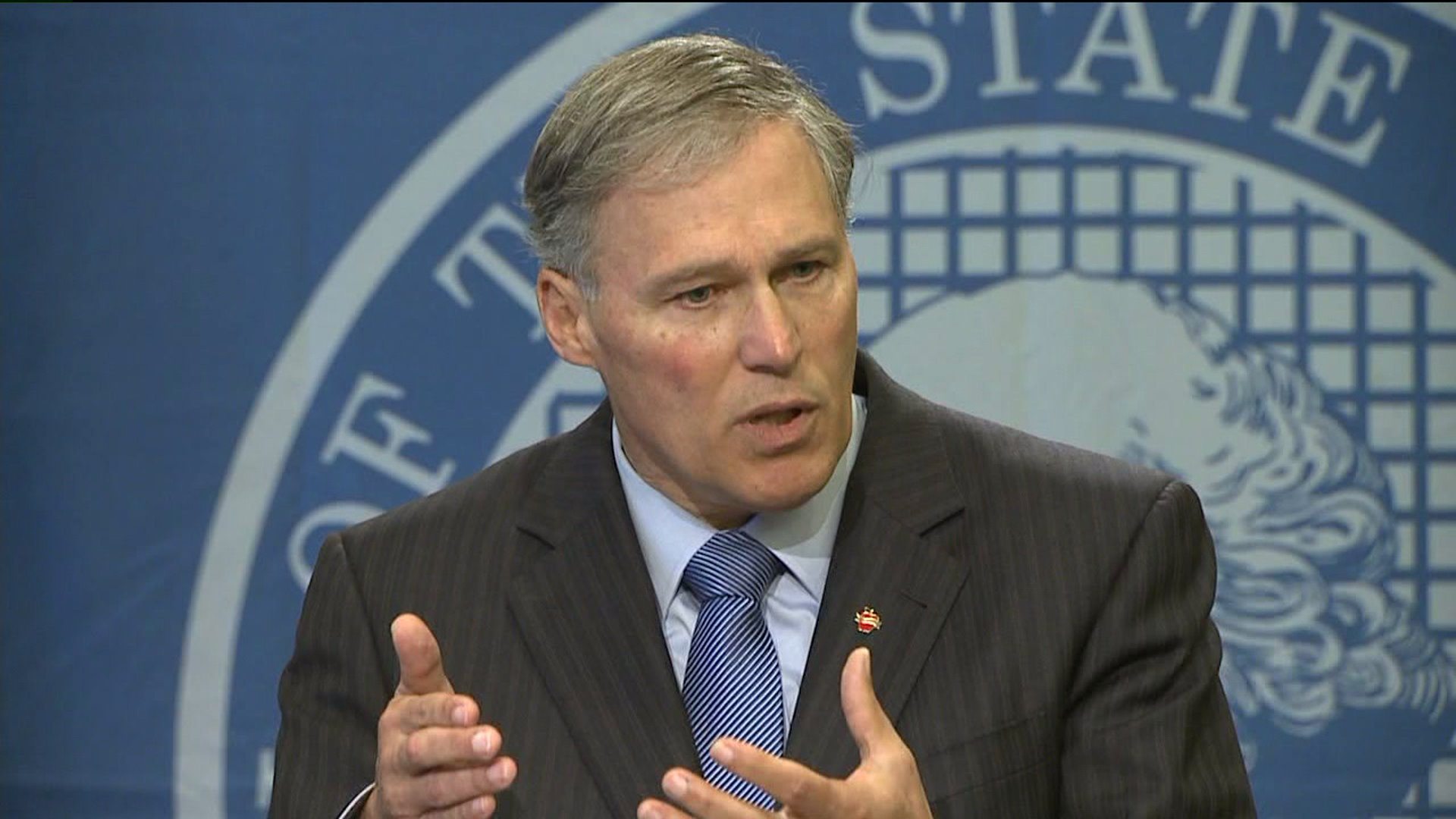

Jay Inslee released his supplemental budget for the 2016 legislative session and—surprise, surprise—he called for new taxes. Rather than cutting costs, Inslee would like to increase spending and pay for the increases by raising a new tax on bottled water.

Keep in mind, as a candidate Inslee insisted that closing tax breaks did not count as increasing taxes. Candidate Inslee answered one interviewer who questioned him on taxes, “My plan is very specific, it does not propose or support tax increases, in general taxes.” Of course, Inslee’s “plan” included closing certain tax breaks to generate revenue.

But, since then, our green governor has changed his opinion. After the state Legislature voted to close certain tax breaks for a net revenue increase of $180.3 million, Inslee applauded the closures as… tax increases. So, for the sake of clarity, we’re going with Inslee’s latest definition of closing tax breaks and calling them tax increases. That’s why we feel comfortable in saying Inslee just proposed a tax increase… again.

Another chance for Inslee to break his pledge

Inslee’s supplemental budget is just another way our green governor has broken his no-new-taxes campaign promise. As a gubernatorial candidate, Inslee promised he would not raise taxes—time and time again. As a governor, Inslee has attempted to raise taxes—time and time again. This is Inslee’s fourth straight budget that proposes tax increases.

Unfortunately, outside of Shift’s reporting, the mainstream media has largely ignored Inslee’s broken no-new-taxes campaign promises. That fact has inspired us to launch a new series on the least reported on—yet important—stories over the next ten days, beginning with Inslee’s record of broken campaign promise.

In an attempt to cover his tracks concerning his no-new-taxes campaign promise, Inslee has insisted that “circumstances have changed” since his gubernatorial bid. Referencing the Supreme Court’s contempt ruling against lawmakers on education funding, Inslee said, “The world is a different place… We’ve had a very unique, unprecedented event in our state’s history.”

But, are Washington State’s budget demands really all that different than in 2012?

When Inslee made his no-new-taxes campaign promise in 2012, the Supreme Court had already handed down its McClearly decision. Candidate Inslee knew that, as governor, he held the responsibility of ensuring the state budget fully funded K-12 education. The Supreme Court’s subsequent rulings in 2014 and 2015 did nothing to change that reality. The facts remain the same, Washington State’s budget still needs to prioritize education spending before general government.

Washington State faces projected revenue growth, as Shift has reported. Yet, despite the projected growth, the Office of Financial Management (OFM) has warned lawmakers that they face red ink if they don’t start controlling spending.

Rather than controlling spending and fulfilling the McCleary decision, Inslee decided that he would instead spend more by rewarding his biggest campaign donors, including the Service Employee International Union (SEIU) 775 and the Washington Federation of State Employees (WFSE).

If the world of Washington State’s budget demands is really all that different than in 2012, it is because Inslee made it that way. The facts are the facts. Candidate Inslee knew the budget demands—especially fulfilling the McCleary decision—when he made his no-new-taxes promise. Those essential demands have not changed. What has changed is that Inslee wants to grow government by raising taxes in order to reward his biggest campaign donors.

In order to pay for those rewards, Inslee is willing to break his campaign promise and raise taxes on hardworking Washington families.