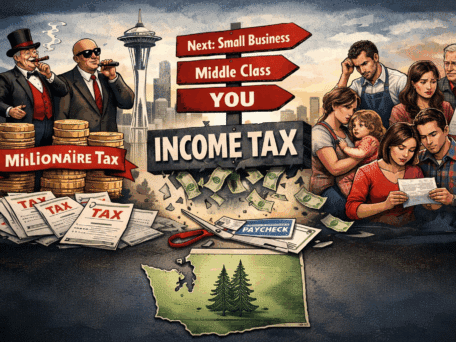

It’s not difficult to see why liberal progressives are pleased with the state House Democrats’ $39 billion budget. After all, it follows Jay Inslee’s lead and includes a historic $5.2 billion spending increase (up 15.4% from the last budget) and a state capital gains income tax. The only real budget element liberals have to lament is the lack of Inslee’s beloved cap-and-tax scheme—though Shift was the lone media voice pointing out that it was House Democrats, not legislative Republicans, who could not provide enough support to pass Inslee’s gas-price raising scheme in the weeks leading up to the budget introduction.

Fuse Washington, a far-left advocacy organization underwritten by rich Seattle liberals, praised the House Democrats’ budget as “good news” immediately following its introduction—so soon after its introduction, in fact, that one assumes that Fuse had received the budget details – and supportive talking points – before it was released to the public. In an email to supporters, Fuse labeled House Democrats’ budget as a “proposal that charts a [liberal] progressive course for Washington.”

Specifically, Fuse states it is “thrilled” that Democrats placed a state capital gains income tax as the “centerpiece of the House budget.” It claims that a state capital gains income tax is “a long-term reform that would put us on track for a sustainable budget.”

Just to be clear, the far-left activists over a Fuse are “thrilled” that House Democrats based their budget on a tax that is notorious for its volatility. And, they claim that this same volatile tax would somehow place Washington State on track for budget sustainability.

As Shift has reported, a state capital gains income tax is extremely risky, and thus an unreliable source of revenue. For Democrats to place the tax as the “centerpiece” of their budget is irresponsible. The fact that Democrats rely on a state capital gains income tax to fund K-12 education as directed by the state Supreme Court makes the House budget, simply put, reckless.

The history of the state capital gains income tax in other states proves its volatility. California’s Legislative Budget Office (LAO) advised that the best way for the state to limit exposure to “to the kind of extreme revenue volatility experienced in the past decade would be to reduce its dependence on the source of income that produced the greatest portion of this revenue volatility—namely, capital gains…” Standard & Poor’s warned that state tax revenue trends have become “volatile as progressive tax states have come to rely more heavily on capital gains from top earners.”

Volatility is not the only characteristic of the “centerpiece” of Democrats’ budget that makes it unreliable. A state capital gains income tax is just another form of a state income tax. If classified as an income tax (and not an excise tax, as Democrats claim), the proposed state capital gains income tax is unconstitutional. As the Washington Policy Center points out, “Under the state constitution, property cannot be taxed at a rate greater than 1 percent and the taxes must be uniform. The state Supreme Court has repeatedly ruled that “income” is property and that taxes on income must conform to the 1 percent limit.”

Democrats and their far-left supports justify a state capital gains income tax by falsely claiming the new tax is needed to meet the state Supreme Court’s McCleary decision to fully fund our public schools. That’s simply not true, as GOP state Sen. Andy Hill pointed out. Following House Democrats’ introduction of their budget, Hill cited the state’s projected revenue increase of $3 billion over the next two years, and re-iterated what he has said from the beginning: “Tax increases should be the last resort, not the first response.”

Democrats need new taxes not to meet their constitutional obligation and appropriately fund our schools, but to reward their million-dollar campaign donors—including the Washington Education Association, the Washington Federation of State Employees and the Service Employees International Union (SEIU) —with nearly a billion dollars in pay raises.

House Democrats introduced a budget that relies heavily on a volatile, unreliable state capital gains tax—it’s the budget “centerpiece,” as Fuse put it. That’s nothing to be “thrilled” about. In fact, it just proves that Democrats have reverted back to their old ways and are refusing to prioritize education. Once again, they have placed special interests before education funding.