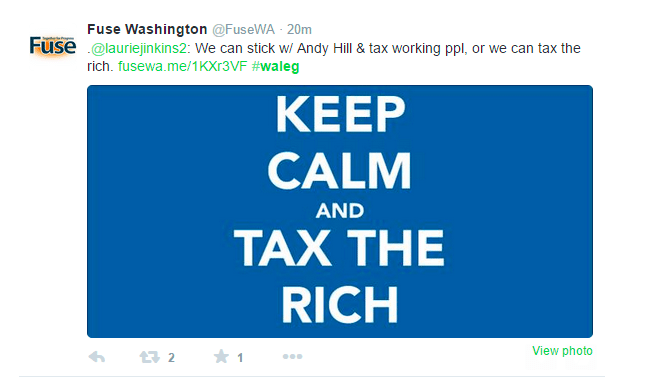

Fuse Washington, the secretive far-left organization recently rebuked for its ridiculous attack on members of the state Senate Majority Coalition Caucus, really wants the state budget to include a state capital gains income tax. The group recently tweeted this to Democrat state Rep. Laurie Jinkins following her op-ed piece (which Shift recently took apart):

It appears as though Fuse has no problem with parodying itself, because that’s just what they did. The tweet wraps up Democrats’—and their far-left supporters’—reaction to pretty much any budget problem: raise taxes. Here’s the thing: our state does not face a revenue problem.

Last month, state economists released the latest revenue forecast and told lawmakers they could “count on another $400 million without raising taxes a dime.” That means lawmakers have $3.2 billion (a whopping 9.2% increase) more in tax revenue than they had last time they wrote the state budget. The $3.2 billion does not include “things like money that comes in before June 30,” which allow the state to build a larger reserve fund.

In other words, the state has more than enough revenue to meet all funding obligations without raising taxes on working families. Yet, Democrats and far-left supporters like Fuse insist on tax hikes—particularly, a state capital gains income tax. They justify the tax on two claims: (1) the tax is needed and (2) the tax would make our state’s tax system fairer.

As previously stated, the first claim is false. The state has enough revenue to meet funding needs. That leaves the second claim. So, is a capital gains tax really fair? Considering the disproportionate impact the tax has in the long term, no.

As Shift has pointed out, a study conducted by the Tax Foundation found that our nation’s high capital gains tax—let alone an additional state-level capital gains tax—is “problematic, because the capital gains tax creates a bias against savings, slows economic growth, and places a double-tax on corporate profits.” Additionally, the Tax Foundation points out that “although these problems with the capital gains tax are well known, there is a more subtle issue with the tax that makes it even worse for taxpayers than these conventional concerns suggest.” The Tax Foundation,

“Under the federal tax code, the increase in an asset’s price is determined as the nominal amount (i.e., not adjusted for inflation). When an asset (often a stock) is sold above its purchase price, a gain is realized and is taxed. Any capital gain due to inflation is not accounted for, and the taxpayer is taxed on both their increase in income and on increases in prices economy-wide. As a result, the effective tax rate on the real (inflation indexed) capital gain has exceeded the statutory rate every year since 1950 and has averaged around 42 percent.

“In some instances, the practice of taxing the nominal gain can lead to an infinite effective rate on real capital gains when the increase in price is only due to inflation. In fact, if a taxpayer purchased an average stock in 1999, 2000, or 2007 and sold in 2013, they would be taxed entirely on inflation.”

Is it fair to tax an investor on stocks or property that increased in price only due to inflation? Is a tax that creates bias over saving and investment fair? The rational answers to both questions are “no” and “no.”