Everyone, from the right to the left, agrees – the property tax is one of the most egregious forms of taxation. It hits the poor and elderly hard and, on a philosophical level, it calls into question whether or not you can truly own a home, or any piece of property, if the government can take it from you for not making regular payments.

As one financial reporter put it, “You don’t own anything which you must pay property taxes on—you are merely renting it from the government.” There is an important difference between merely possessing property and actually owning it.

The property tax removes any sense of security. Under the tax burden, you never truly own your home. Of course, the tax also drives up home and rental costs.

Yet, King County continues to abuse the property tax. This year, the tax increased across King County by 9.35 percent. In Seattle, the property tax jumped by a whopping 15 percent on average. Seattle homeowners (and renters) can thank King County Metro’s “Move Seattle” and the so-called “democracy vouchers ” – public financing of political campaigns in plain English – for the recent increase.

To put the extraordinary rates into perspective, here’s a short list of property tax rates in countries liberals love to glorify:

- In Sweden, property tax rates range between 0.2% and 2.8% on the tax assessed value of the property.

- The Netherlands levels real estate taxes “based on the value of the property and are paid by both the owner and the user.” Tax rates (applicable for four years) are determined by municipalities and typically range between 0.1% and 0.3% of the property value.

- In Italy, property owners can expect to pay a municipal “service tax” of 0.3%-0.8% a year.

- Croatia, Liechtenstein, Malta, and Monaco have no property taxes.

There are a host of problems that come with comparing any country’s public policies to that of the United States. But, we’re just taking a page out of liberals’ playbook. After all, socialist Bernie Sanders does it all the time and he gets away with it.

The real point is that property taxes are out-of-control. And, yesterday, we found out that the liberals running Sound Transit want to impose even higher property taxes.

If voters approve Sound Transit 3 (ST3) this fall, they could increase the property tax by 25 cents per $1,000 valuation. Worse, this tax increase would be imposed indefinitely.

The high property tax rates burdening property owners and renters even have some liberals raising their eyebrows. Democrat King County Assessor John Wilson recently wrote of existing rates:

“Our elected officials are working hard to combat the high cost of housing. Yet, I wonder whether our continued reliance on the property tax is adding to higher housing costs and aggravating the affordability crisis for renters and homeowners alike…

“There are no easy answers. But ignoring how we pay for our municipal needs and wants only invites problems we can and should avoid. Older homeowners like the gentleman from Columbia City shouldn’t live in fear of being taxed out of their homes. And middle-class families, whether homeowners or renters, form the economic foundation for a sustainable community.”

Democrat State Senator Reuven Carlyle expressed hesitancy toward ST3 following the announcement. Carlyle said he was “neutral” for now and called for “sober reflection among leaders and voters.” Via the Seattle Times:

“‘It consumes the oxygen in the room, regarding the larger questions of what we want to invest in,’ he said. In particular, education has historically depended on property taxes, and ST3 adds competition for those, he said.

“And if lawmakers choose later to boost property taxes — to meet the McCleary court order for adequate school funding — there might not be enough tax capacity within legal limits to fund parks or local services, said Carlyle, whose district includes Ballard.”

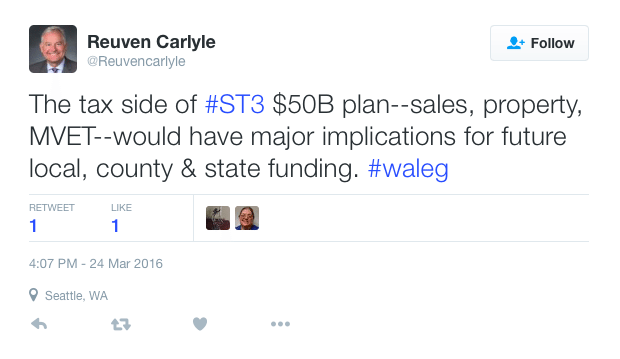

Carlyle also tweeted:

Property tax rates are unsustainable. Voters should listen to Carlyle (never thought we’d say that) and soberly reflect on the heavy burden property owners already carry from this egregious form of taxation.

As the Guardian put it concerning property tax increases in Greece, “If you want to punish your child, you threaten to pass on property to them.”

Most people want to be able to leave something for their children. High property taxes pose a threat to even that sacred tradition.

And, lest renters assume that another property tax hike would not impact them, they should think again. They too will feel the burden when their rent payment increases.

Enough is enough. Sound Transit officials should be ashamed of themselves for even asking voters for so much.