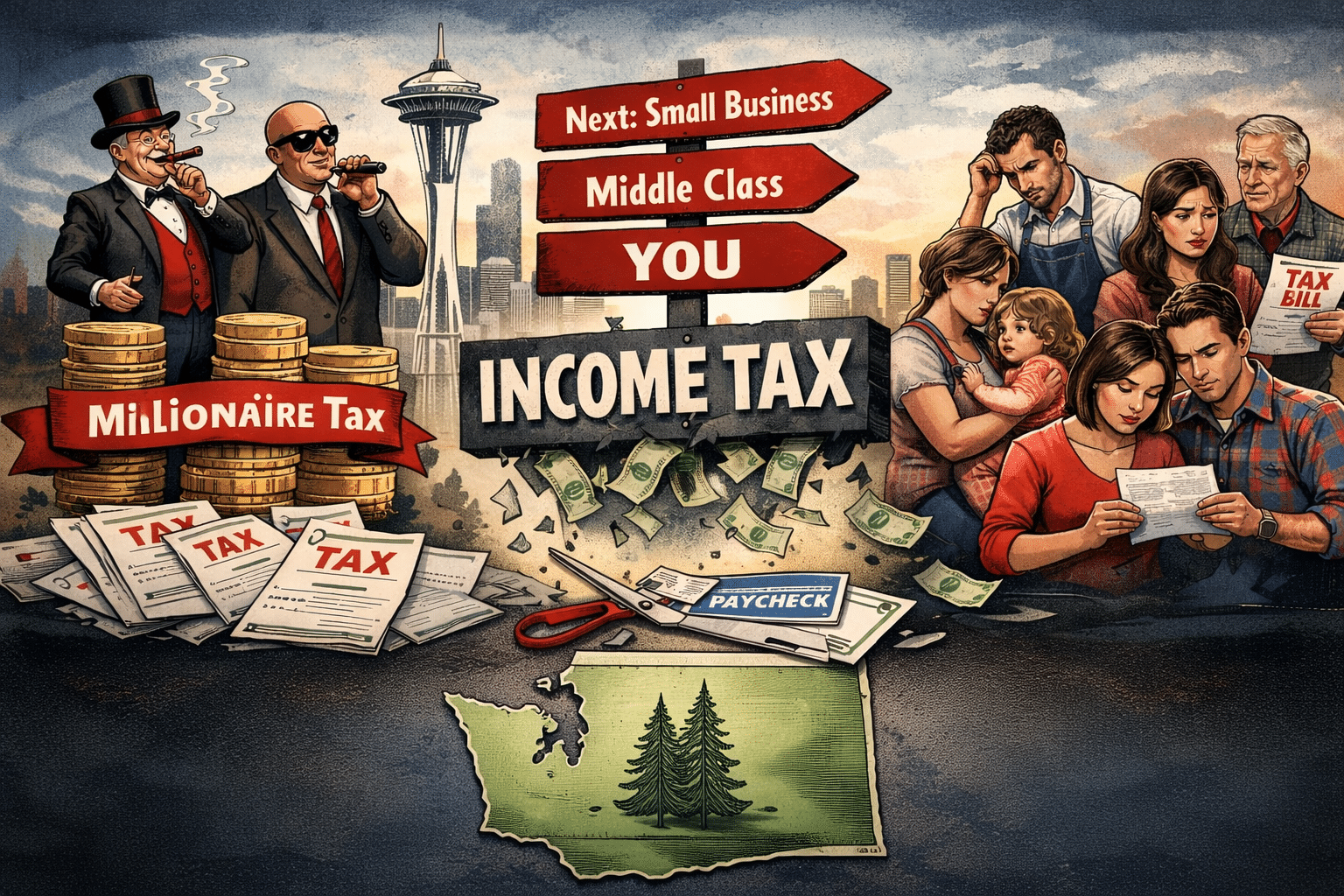

Washington Democrats are back with one of their favorite ideas: an income tax. This time, they’re calling it a “millionaire tax” and promising, once again, that it will only hit the wealthy. Gov. Bob Ferguson and legislative Democrats want to impose a 9.9% tax on income above $1 million, a move that would fundamentally change how Washington raises revenue.

And as always, the sales pitch is the same: Don’t worry. It’s only for them, not you.

We’ve heard that before.

A New Tax That Doesn’t Fix the Current Problem

Ferguson claims fewer than 0.5% of Washington residents would pay the tax and that it could generate $3 billion a year. That sounds impressive until you look at the fine print. The revenue wouldn’t show up until at least 2029 because the tax would face court challenges and require years to build a new collection system.

So while Democrats are selling this as part of a response to a budget shortfall, it wouldn’t help the budget shortfall at all. Not this year. Not next year. Not even in the next biennium.

They’re proposing a permanent structural change to the tax system that doesn’t solve today’s crisis, but absolutely reshapes tomorrow’s.

That should concern everyone.

“Fairness” Is the Pitch, Expansion Is the Reality

House Speaker Laurie Jinkins says the goal is to make the tax system “more fair.” That’s the marketing language. The reality is that income taxes never stay limited to their original targets.

Once the state has:

- Built the bureaucracy

- Installed the collection systems

- Structured budgets around the revenue

…the pressure to expand the tax becomes inevitable.

Republicans are saying the quiet part out loud. As Rep. Drew Stokesbary put it, it might be millionaires today, but it will be the middle class tomorrow. And history backs him up.

This is how income taxes always evolve:

- Start with a politically convenient group (“the rich”).

- Build the infrastructure to collect the tax.

- Grow government spending.

- Let inflation push more people into the bracket.

- Lower the threshold “just a little.”

- Expand the tax base.

- Send the bill to the middle class.

It’s not a theory. It’s a pattern.

“Some” Tax Relief… For Optics

Democrats also promise that some of the revenue could be used for tax relief for others—low-income residents, small businesses, maybe property owners. Notice the careful wording. Some. Not all. Not most.

Just enough to make the policy sound balanced, while the majority of the money feeds an ever-growing state budget.

If this were truly about tax relief, the plan would be built around returning money to taxpayers. Instead, tax relief is an optional talking point, not the core mission.

Voters Have Already Rejected This

Washington doesn’t have an income tax because voters have said no to one over and over again. Not narrowly. Not accidentally. Clearly and consistently.

This isn’t a new idea that needs better messaging. It’s an old idea that keeps losing. So now it’s being repackaged under a different label with a carefully chosen villain: “the millionaires.”

But once the tax exists, it stops being about millionaires. It becomes about revenue. And revenue never has enough.

The Truth Democrats Won’t Say

This proposal isn’t about fairness. It’s about opening the door.

Once that door is open:

- The threshold shrinks

- The tax base expands

- The middle class gets pulled in

First it’s CEOs.

Then it’s small business owners.

Then it’s dual-income families.

Then it’s retirees who saved responsibly.

That’s why Washington doesn’t have an income tax. And that’s why Democrats are trying to slip one in through the side door.

Because they know something most taxpayers already understand:

It never stops where they say it will.